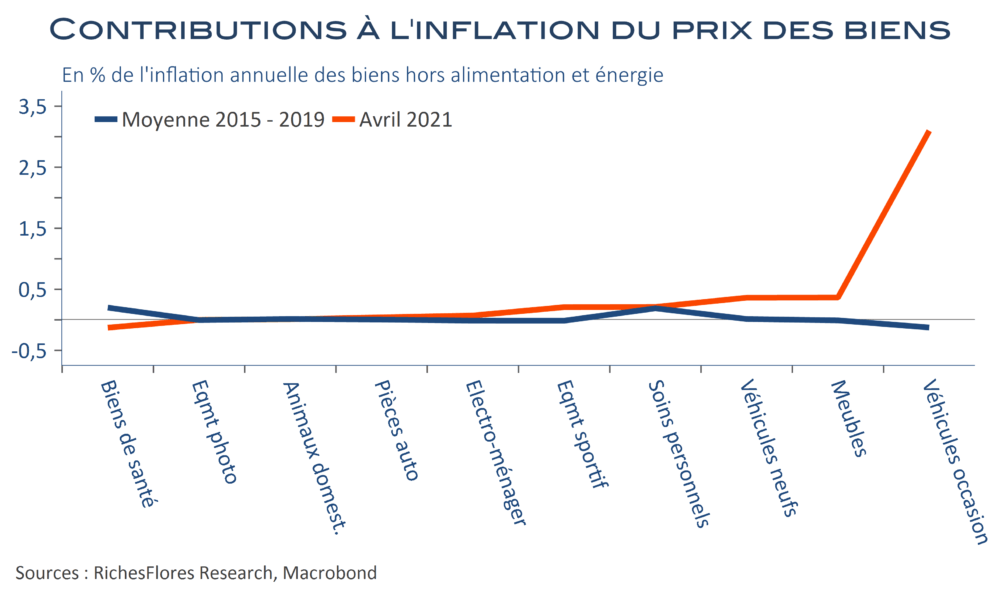

L’inflation américaine s’est envolée à 4,2 % l’an en avril, après 2,6 % en mars ; un plus haut depuis septembre 2008, sous le coup d’une hausse mensuelle des prix de 0,8 % et de puissants effets de base. Mauvaise surprise, l’inflation sous-jacente, s’est également emballée à 3 %, contre 1,6 % en mars. À première vue, ces résultats ne sont pas bons et certains ne manqueront pas d’y voir la concrétisation d’un environnement définitivement plus inflationniste. Les détails du rapport ne valident pas ce diagnostic, tout du moins, pas à ce stade. Au-delà de l’impact des effets de base, l’accélération de l’inflation tient, en effet, à quasiment un seul phénomène : l’envolée des prix des véhicules d’occasion de 10 % entre mars et avril, qui explique à elle seule le tiers de la hausse de l’inflation du mois d’avril.