Download the article

2014 is off to a positive start: U.S. growth is trending upward, the euro area is pulling out of recession, Japan is reaping the benefits of its competitive strategy, and world trade is picking up. All these bright spots should be enough to end two years of global deceleration and bring about a return to growth of over 3 percent this year. But while this is certainly good news, it doesn’t tell us much about the key challenges ahead. To understand them, we need to address the much more complex question of whether 2014 will usher in a second leg of the global recovery—one that is sufficiently sturdy to ensure a lasting upswing and leave five years of convalescence well behind us. As things now stand, we feel we still have two good reasons for assuming it won’t:

- The deleveraging process is still producing dysfunctional effects around the world.

- Five years of crisis have seriously eroded the global economy’s growth potential and its ability to handle the higher interest rates the current upturn will inevitably entail.

This suggests that we are in for a period of economic instability. We are therefore forecasting that after 3.5 percent growth in 2014, global GDP will increase by only 3 percent in 2015.

The upturn, then, is likely to be short-lived, yet it’s still a reality—meaning it will necessarily affect market expectations.

We are sharply raising our long-term interest-rate forecast for the first half of 2014, but we predict backsliding before the year is out. Needless to say, there will be timid attempts at returning to normal monetary policy in the first few months of the year, but because they are unlikely to get very far, our outlook up to mid-2015 does not involve increases in key rates by the leading central banks—the Federal Reserve, the ECB, the BoJ.

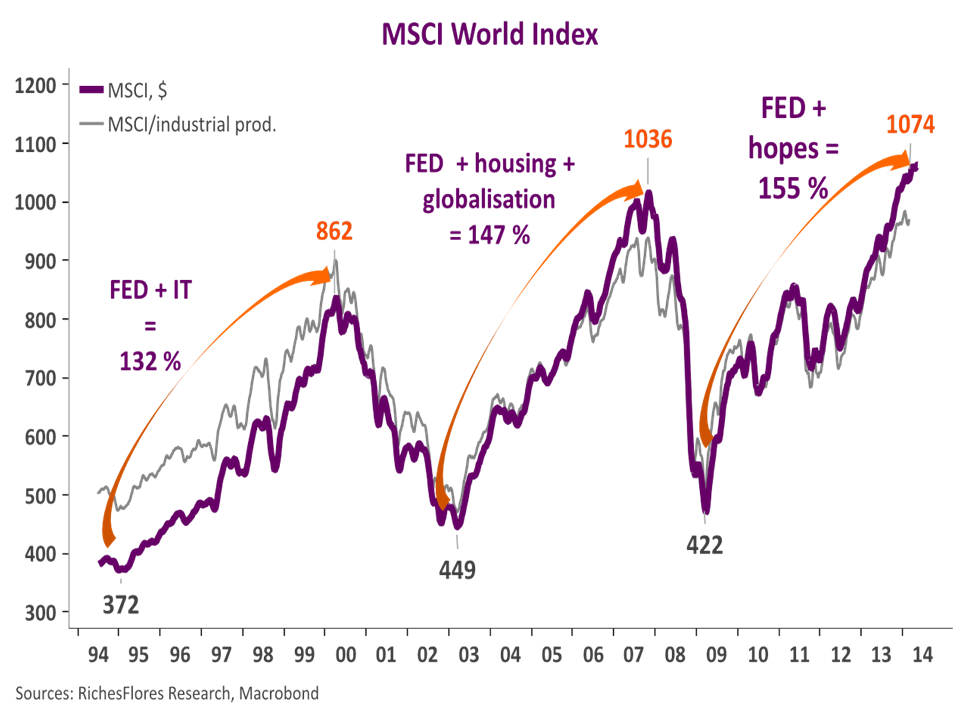

Although initially encouraged by the improved economic climate to press ahead with tapering, the Fed may soon find itself overwhelmed by largely uncontrollable jumps in long-term Treasury yields.

All in all, this should be a highly volatile year.