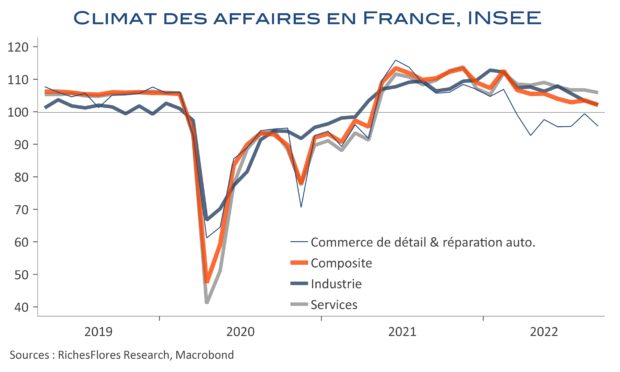

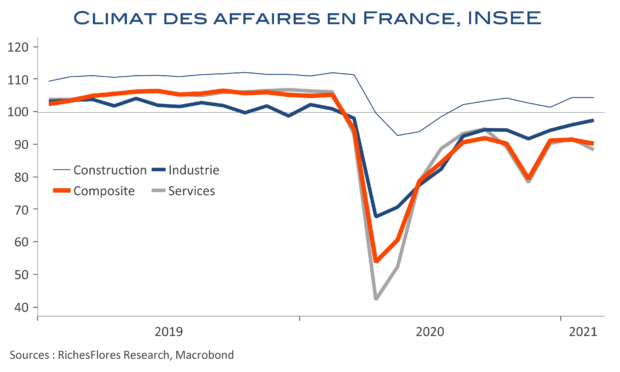

Les incertitudes en présence conduisent l’économiste à chercher dans les données de conjoncture et d’enquêtes des indices de l’ampleur de la crise qui guette l’Europe. Si l’on en croît les climats des affaires de l’INSEE, rien de terrible, pour l’heure, du moins. Tiré à la baisse par toutes ses principales composantes, l’indicateur composite perd deux points à 102. Cela correspond à un recul de 10 points depuis février mais à un niveau toujours supérieur à la moyenne de long terme. Cette trajectoire descendante et les conséquences, pour l’heure diffuses, des pertes de pouvoir d’achat, alimentent les craintes de récession, sans pour autant indiquer de choc d’ampleur. Un constat qui n’en reste pas moins précaire à la veille de l’hiver.