If we’re correct in assuming the Federal Reserve is not about to start scaling back its asset purchases, worldwide liquidity injections should hit a new high next year. Whereas the aggregate balance sheet of the four leading central banks showed little change in the first half of 2013, we can expect widespread central bank activism over the next few quarters:

- At a rate of 85 billion dollars a month, the Fed’s asset purchases should amount to 1.02 trillion dollars a year.

- The Bank of Japan will be adding anywhere from 600 to 718 billion dollars to its balance sheet as it strives to meet its target of expanding Japan’s monetary base by between 60 and 70 trillion yen a year (making it some 40 percent larger than at the beginning of 2013).

- The Bank of England will be buying 610 billion dollars’ worth of Gilts in connection with its objective to purchase 375 billion pounds of assets via its Asset Purchase Facility.

- The ECB’s probable upcoming LTRO is likely, in our estimate, to provide Europe’s banks with between 250 and 500 billion euros, or 350 to 750 billion dollars.

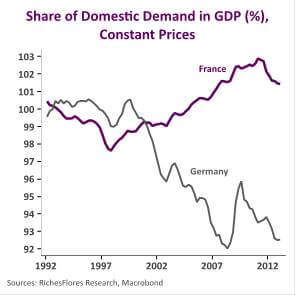

The “Big Four” should thus be injecting a cool 1.6 to 2.5 trillion dollars into the system in annual terms (at a pace of 135 to 208 billion a month). This should continue, if not throughout 2014, then at least through the early part of the year. In the low-case scenario, that would equal 10 percent of American GDP; in the high-case scenario, it would equal almost the entire size of France’s economy in 2012! But whether the ECB follows suit or not, the annual flow of fresh liquidity should return to the highs seen in 2011 and 2012—and for the ECB’s LTROs, could even set a post-2008-crisis record.