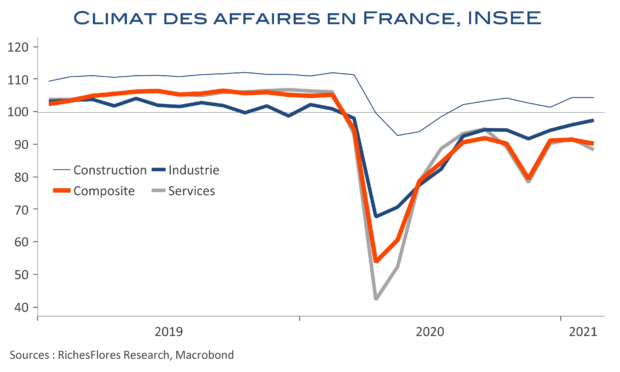

L’indice de climat des affaires de l’INSEE recule d’un point, à 90, sous l’effet d’une baisse de 3 points de l’indicateur des services. Des chiffres qui reflètent toujours une situation sanitaire incertaine et l’impact des restrictions, rien de très nouveau de ce point de vue, donc, à ceci près que la place prépondérante du tertiaire dans l’économie française, plus importante notamment qu’en Allemagne, constitue un frein à la reprise. La situation est différente dans l’industrie, puisque, malgré un niveau toujours inférieur à sa moyenne de long terme, l’indicateur manufacturier poursuit son rattrapage et gagne un point, à un niveau proche de ceux d’avant crise, de 97. Reste que cette amélioration repose pour une bonne part sur des hypothèses très optimistes des industriels sur leur activité et leurs prix futurs. Mieux vaudrait pour cela que leurs commandes s’alignent sur ces attentes. Ce n’est pas encore le cas…