Most pundits agree that the question isn’t if the Fed will taper off its liquidity injections, but by how much. And they hope to find answers in the minutes of the next FOMC meeting a month from now. It’s unlikely the Fed will backtrack from previous guidance; even that was enough to steer markets back in the right direction. Long-term interest rates are returning to more normal levels, and capital is starting to flow back into money-market funds. An about-face by the Fed at this point would be more likely to wreak havoc than anything else. However, a closer look reveals that the economic indicators predicating investors’ newfound optimism don’t actually point to a U.S. recovery (see below). Many of these indicators remain weak, signaling that the world’s largest economy isn’t strong enough yet for a return to regular interest rate levels.

Tag Archives: Employment

The U.S. Economy: Don’t Count Your Chickens Before They Hatch

Sentiment on the U.S. economic outlook has gone from a flurry of uncertainty at the start of the year to renewed optimism. Admittedly, there are grounds for being bullish. Growth has held up despite tougher fiscal and tax policies; the housing market recovery has continued; and the Fed has stuck to its easy money policy. But let’s not get carried away! The latest numbers are no more encouraging than those available at the end of last year. In particular, decelerating productivity growth, with all that it implies in terms of profit, investment, and job trends in the next few quarters, may well drag the U.S. economy back down in the second half of the year. And with a policy mix that is less accommodative than before, the key ingredients for a genuine recovery are still nowhere to be seen. All this has conditioned our analysis on several points:

- We wonder whether a change in monetary policy is on the short-term agenda—and worry that the Fed may withdraw its support too soon.

- While we aren’t overly concerned about trends in the U.S. bond market and the euro’s exchange rate, we do suspect that the stock market will be more vulnerable to disappointing macroeconomic data.

- We have very little faith in the American economy’s chances of regaining its status as powerhouse of the global economy before the year is out.

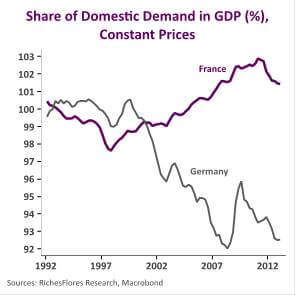

France–Germany: Comparing 20 Years of Economic History

Like all crises, the present one provides a fertile breeding ground for dogmatic, cookie-cutter statements and clichés that don’t always square with reality. So perhaps the best way to avoid making disastrous decisions on the momentous issues of today is to take a good, hard look at our past. This view was what prompted us to publish the following series of charts, which sum up twenty years of comparative economic history in France and Germany.

Like all crises, the present one provides a fertile breeding ground for dogmatic, cookie-cutter statements and clichés that don’t always square with reality. So perhaps the best way to avoid making disastrous decisions on the momentous issues of today is to take a good, hard look at our past. This view was what prompted us to publish the following series of charts, which sum up twenty years of comparative economic history in France and Germany.

Growth, consumption, employment, real estate, debt, demographics, and foreign trade are the themes we have covered here, in the hope of offering the reader greater insight into the forces at work in the euro area’s two leading economies.