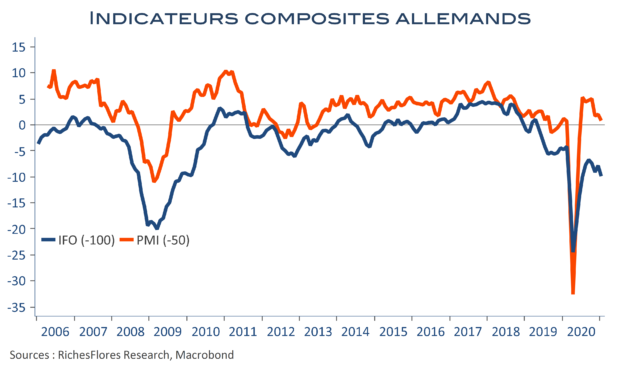

La plupart des indicateurs de climat des affaires de l’IFO pour l’Allemagne affichent des baisses plutôt faibles en janvier, à l’exemple de l’indice composite, qui s’établit à 90 après un recul de deux points de ses deux composantes, « perspectives » et « situation courante ». Son niveau, en revanche, reste toujours très faible, contredisant un PMI composite à 50,8, soit en territoire de croissance. L’occasion ici de rappeler la difficulté d’analyser, en termes d’activité économique, les indicateurs de climat des affaires de façon absolue. L’IFO est resté sous les 100 depuis la mi-2019, quand bien même la croissance au T3 2020 a été exceptionnelle, tandis que les PMI n’ont cessé d’afficher une valeur supérieure à 50 depuis la fin du premier confinement, malgré une dégradation de la situation sanitaire depuis la fin de l’année. Reste que les deux indicateurs s’accordent sur certains points du diagnostic : si le reconfinement a eu un impact franchement négatif sur l’activité, son ampleur en janvier demeure limitée par rapport aux restrictions précédentes, pour ce qui est de l’activité globale, du moins.