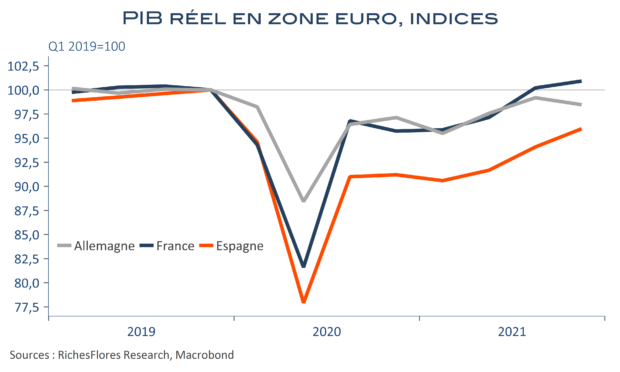

Au quatrième trimestre, la France affiche une hausse de son PIB de 0,7 % qui, combinée aux révisions d’un dixième des trimestres précédents, porte la croissance sur l’ensemble de 2021 à 7 %. L’Espagne fait mieux sur les trois derniers mois de l’année, avec une hausse de 2 % de son PIB. La forte révision du troisième trimestre permet là aussi une croissance annuelle un peu meilleure que prévu, de 5 %. Quant à l’Allemagne, la hausse de 2,8 % sur l’ensemble de 2021 cache une baisse de 0,7 % en fin d’année, sous l’effet, notamment, d’une plus faible mobilité. En termes de rattrapage, la France garde donc largement une position de tête par rapport à ses deux voisins : le PIB hexagonal est supérieur de 0,8 % à celui d’avant crise, alors qu’il est en retard de plus de 4 % en Espagne et de 1,5 % en Allemagne.